Key Features of Investment Approach

- Socialise an Investment approach to the business based on building confidence in your investment decisions, and the roles your people play in those decisions.

- Launch Business Cases, including from Ideas.

- Build ‘Executive Summaries’ in On-line Business Cases.

- Build Investment Profiles, Prioritisation Dimensions, and high-level costs to inform decision-making.

- Connect supporting documents to Business Cases.

- Submit business cases for assessment, and ranking.

- Launch projects from approved business cases.

- See approved initiatives in Strategic Planning and Storyboard views.

STRATEGY to LEARNING

Research shows that projects often fail because of poor business cases coupled to inadequate delivery capability. Also, less than 5% of projects deliver their full tranche of project benefits. organizations falter by trying to deliver more initiatives than they have time, budget and people. To address these issues, and many more, teams need to adopt an enterprise-wide investment approach.

Organizations are very conscious of ensuring their investments deliver bottom-line value. For commercial organizations this equates to profit and shareholder value. For public sector it relates to improved service to community.

Only 23% of Executive teams deliver to strategy, with many simply failing to complete what they start. Many strategies are not supported with executable plans. The key is to have ‘living plans’ to support dynamic, responsive management.

Executives with an agile-mindset to management implement a balanced approach to strategy and delivery where both aspects provide context to the other.

"Strategy needs to transition from a top-down, internally focused discipline, basing future linear forecasts on historical data analysis to a foresight-fueled, externally focused, innovation driven, living discipline."

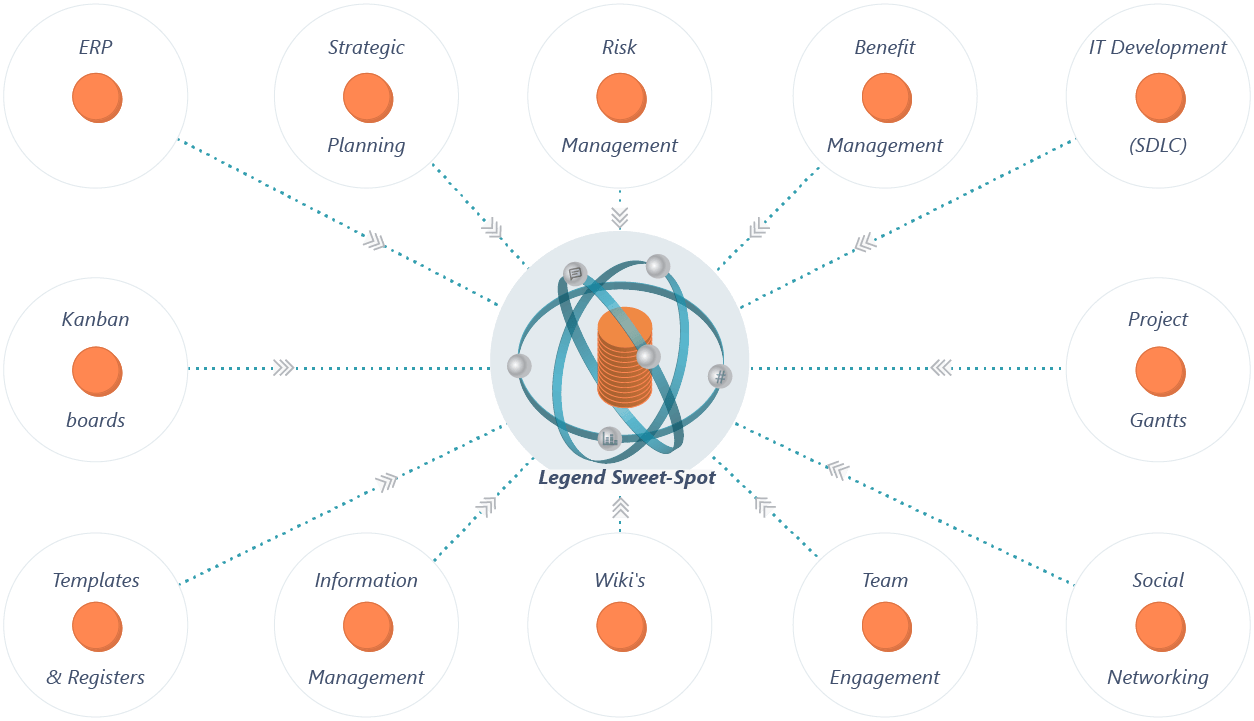

Adopting an Enterprise approach

Investment opportunities kept simple

Business Cases should be prioritised to ensure the organization has the time and people to deliver against any project that is launched. The reality is that organizations can't do everything, and invariably some business cases won't survive the cut. This improves the odds of delivering the approved projects.

Different dimensions can be built up to support Business Cases including Prioritization, and Investment Profiling. organizations will use this information to develop and sign-off on the large and small; low-cost and high-cost; modest-value and high-value, which then form part of the overall business portfolio.

Benefits deliver value

Research indicates that less than 5% of projects deliver measurable benefits.

Programme and Project Benefits are the most practical expression of how you are tracking to the delivery of value. The key is that the business must take ownership of benefits from inception to final realization and review. At all stages of the lifecycle senior management must be aware of the true state-of-play and intervene, when required.

It's useful to look past the financial benefits to non-financial benefits. Every project, for example, is an opportunity to build internal project capability and IP. This means you can focus on the growth of your people, while also building towards the desired project outcomes.

Investment Quick Tips

- The criteria for approval of a business case should not be relentless sponsorship, weight or volume. It should be quality of content and strength of proposition.

- Investment, expressed in benefits, must be owned by the business at all stages of its lifecycle

- Unanticipated value will often come from unexpected places. It needs to be managed so as not to tip-over current initiatives, but still be realized at some point.